Cell and Gene Solutions Market Trends and Growth – A Comprehensive Report by Towards Healthcare

This report by Towards Healthcare, a sister firm of Precedence Research, provides an in-depth analysis of the global cell and gene solutions market, highlighting key trends, growth drivers, and technological advancements.

Ottawa, Oct. 20, 2025 (GLOBE NEWSWIRE) -- The global cell and gene solutions market is experiencing strong growth, with revenues expected to reach several hundred million dollars between 2025 and 2034. This expansion is fueled by technological advancements and shifting industry dynamics that are transforming the landscape.

The market’s momentum is largely driven by rising demand for cell and gene therapy products, supported by increasing investments from both public and private sectors. Leading companies are forming strategic collaborations to leverage cutting-edge technologies and broaden their product and service offerings across key regions. With ongoing innovations in genomic techniques and the integration of AI and machine learning, the market’s future remains highly promising.

Numerous factors influence market growth, including the advancements in cell and gene therapy (CGT) products manufacturing and the growing demand for personalized medicines. The increasing research activities owing to the rising prevalence of chronic and rare disorders potentiate the need for cell and gene solutions. Favorable government support and an evolving regulatory landscape also contribute to market growth.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5902

The Cell and Gene Solutions Market: Highlights

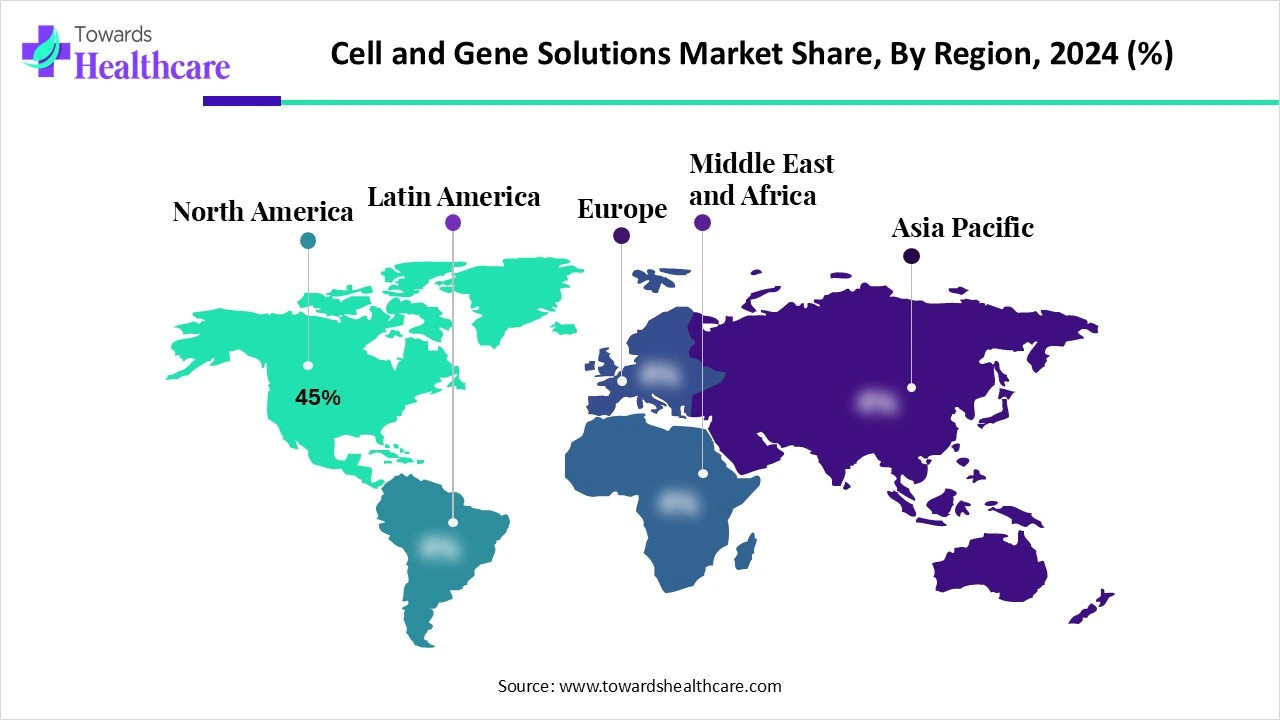

- North America dominated the global market share by 45% in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By therapy type, the cell therapy solutions segment contributed the biggest revenue share of the market in 2024.

- By therapy type, the gene therapy solutions segment is expected to witness the fastest growth in the market over the forecast period.

- By service/technology, the process development & manufacturing segment dominated the cell and gene solutions market in 2024.

- By service/technology, the analytical testing & quality control segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the oncology segment held a dominant revenue share of the market in 2024.

- By application, the rare genetic disorders segment is expected to show the fastest growth over the forecast period.

- By end-user, the biotech startups & clinical stage developers segment led the global market in 2024.

- By end-user, the large biopharma segment is expected to expand rapidly in the market in the coming years.

What are Cell and Gene Solutions?

The cell and gene solutions market refers to the development, manufacturing, delivery, and commercialization of CGTs and their services. Cell and gene solutions encompass a wide range of therapeutics, such as CAR-T cells, stem cells, mRNA, and tissue engineering products. They are used for the treatment of genetic disorders, cancer, neurological disorders, rare diseases, and autoimmune disorders. Biotech companies offer services to simplify workflows, generate reproducible data, and accelerate breakthrough therapies.

New Product Launches: Major Potential

Biopharmaceutical companies focus on developing innovative CGT and expanding their product portfolio, delivering advanced patient care. As of 2023, 76 CGTs were launched globally, more than double the number of therapies that were launched in 2013. The increasing number of biopharma startups and venture capital investments potentiates competition among companies. This encourages them to strengthen their market position. The rising clinical trials also contribute to new product launches, accounting for 969 studies as of October 9, 2025.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Scalability Challenges: Major Limitation

The market faces formidable challenges, including scalability, sustainability, and reproducibility. The complex and resource-intensive manufacturing processes lead to high cost and limited patient access. This is a significant barrier, particularly in low- and middle-income countries, restricting market growth.

The Cell and Gene Solutions Market: Regional Analysis

North America held a major revenue share by 45% of the market in 2024, due to a strong presence of biopharma companies, increasing R&D investments, and favorable regulatory support. Research institutions in North American countries possess state-of-the-art research and development facilities, fostering CGT development. The increasing prevalence of chronic disorders and the growing geriatric population necessitate the development of CGT.

The United States (U.S.) is home to more than 3,000 biotech companies as of 2024. The Food and Drug Administration regulates the approval of CGT products in the U.S. As of August 2025, the FDA has approved a total of 45 CGTs. The U.S. government also provides funding to support the research and manufacturing activities of CGTs. The Biomedical Advanced Research and Development Authority (BARDA) granted $500 million for mRNA vaccine production.

The Canadian Public Health Association (CPHA) reported that approximately 44% of Canadian adults have at least one chronic disease. As of 2025, Health Canada has approved 12 CGTs for various disorders. This paves the way for the development of more CGT products, improving the lives of Canadians. The Canadian government invested $49.9 million in STEMCELL Technologies, Inc. to build biomanufacturing facilities in Canada.

Download the single region market report @ https://www.towardshealthcare.com/checkout/5902

Asia-Pacific is expected to host the fastest-growing cell and gene solutions market in the coming years.

The growing research and development activities and the increasing demand for personalized medicines boost the market. Countries like China, India, and Japan have suitable manufacturing infrastructure and an affordable workforce, encouraging foreign companies to set up their manufacturing facilities in these countries. The rapidly expanding contract research organizations (CROs) landscape and the burgeoning healthcare sector augment the market.

China is a major player in cell and gene therapy (CGT), with a booming industry driven by strong government support, regulatory reforms, and a rapidly growing pipeline of clinical trials. Key areas include CAR-T therapies for cancer and gene therapies for rare diseases, with companies like Grit Bio and EdiGene developing treatments for solid tumors and beta-thalassemia, respectively. Several AAV-based therapies are also advancing, and international collaboration is increasing.

The Cell and Gene Solutions Market: Segmentation Analysis

By Therapy Type

The cell therapy solutions segment held the largest revenue share of the market in 2024, due to the ability of cell therapy to self-renew and differentiate, and potentially higher success rates. Cell therapies are comparatively more affordable and involve a comparatively less complex process for their development, boosting the segment’s growth. The growing awareness among people to store umbilical cord blood in stem cell banks bolsters the development of cell therapies. Cell therapies are beneficial in numerous neurological disorders and blood cancers.

The gene therapy solutions segment is expected to grow at the fastest CAGR in the market during the forecast period. Advancements in gene editing technologies and the growing need to treat a disease from its root cause encourage researchers to develop gene therapy. Gene therapy finds immense potential in treating cancer, cystic fibrosis, heart disease, diabetes, hemophilia, and AIDS. It provides long-lasting effects and is usually a one-time treatment, enhancing patient convenience.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

By Service/Technology

The process development & manufacturing segment led the cell and gene solutions market in 2024, due to the advent of advanced technologies. CGT process development requires the coordination of many parts, including cells, DNA constructs, and gene delivery vectors. Automated systems, such as robotics and digital platforms, revolutionize process development and accelerate the speed of CGT development. They address critical challenges of conventional manufacturing.

The analytical testing & quality control segment is expected to expand rapidly in the market in the coming years. CGTs are analyzed to determine their purity and safety profile. Quality control for CGT is highly individualized and specific to the product and process. Stringent regulations necessitate researchers to validate the development process of CGT. CGT must comply with the contamination control strategy (CCS) to mitigate risk at various stages of the aseptic production lifecycle.

By Application

The oncology segment accounted for the highest revenue share of the cell and gene solutions market in 2024, due to the rising prevalence of cancer and its complexity. Ongoing efforts are made to identify novel biomarkers involved in disease progression. This helps researchers to develop tailored therapeutics based on individual needs. The U.S. FDA has approved a total of 11 CGTs for various cancer types.

The rare genetic disorders segment is expected to witness the fastest growth in the market over the forecast period. Rare diseases are incurable by conventional small-molecule drugs, fostering the development of CGTs. CGTs offer significant hope in treating rare diseases by targeting their genetic causes. The increasingly rare disease incidence potentiates the demand for CGTs. It is estimated that over 300 million people in the world are suffering from rare diseases.

By End-User

The biotech startups & clinical stage developers segment registered its dominance over the global cell and gene solutions market in 2024, due to venture capital investments and a lack of sufficient manpower. Biotech startups & clinical stage developers collaborate with CROs to access advanced technologies and receive customized solutions for their complex problems. CROs also provide relevant expertise throughout the entire product lifecycle.

The large biopharma segment is expected to show the fastest growth over the forecast period. Large biopharma companies conduct multiple projects simultaneously, encouraging them to collaborate with CROs. This enables them to focus on their core competencies, such as product sales and marketing. The increasing competition among key biopharma companies facilitates them to develop more innovative products, positioning themselves as global leaders in the CGT field.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Top Companies & Their Contributions in the Market

| Companies | Contributions & Offerings |

| Lonza Group AG | It offers a complete suite of CGT services, including cell line development, process development, cGMP manufacturing, and commercialization of life-changing therapies. |

| Catalent, Inc. | Catalent Cell and Gene Therapy is an industry-leading CDMO with deep expertise in viral vector development, scale-up, and manufacturing for CGTs. |

| WuXi AppTec | It is a global CRDMO that specializes in clinical and commercial manufacturing of CGT. |

| Pantheon Pharma Services | It provides end-to-end CGT CDMO services, offering development & manufacturing services for viral vectors, plasmid DNA, cell therapies, and mRNA products. |

Recent Developments in the Cell and Gene Solutions Market

- In October 2025, Cayman Chemical announced a distribution partnership with Akadeum Life Sciences to expand access to Akadeum’s cell isolation technology for CGT development. Cayman will distribute Akadeum’s portfolio of buoyant microbubble cell isolation kits across the world to support life science research and discovery.

- In October 2025, Peli BioThermal announced the acquisition of Evo from BioLife Solutions to expand its product portfolio. The Evo portfolio includes cryogenic shippers and the evoIS technology platform designed for CGT development, benefiting pharmaceutical, biopharmaceutical, and clinical supply customers.

- In October 2024, Terumo announced the availability of its offerings in Latin American countries, such as Brazil, Colombia, and Mexico. It advances the adoption of automated manufacturing to increase access to CGT products among Latin American patients.

Browse More Insights of Towards Healthcare:

The North America cell and gene therapy market is valued at US$ 9.19 billion in 2024, expected to rise to US$ 11.34 billion in 2025, and projected to reach approximately US$ 79.01 billion by 2034, expanding at a CAGR of 24.01% from 2025 to 2034.

The Europe cell and gene therapy market is estimated at US$ 2.74 billion in 2024, anticipated to increase to US$ 7.17 billion in 2025, and forecasted to attain around US$ 48.96 billion by 2034, registering a CAGR of 23.90% during the same period.

The Latin America cell and gene therapy market was valued at US$ 1.15 billion in 2024, is expected to grow to US$ 1.42 billion in 2025, and projected to reach nearly US$ 10.19 billion by 2034, advancing at a CAGR of 24.40% through the forecast timeline.

The Middle East and Africa market stood at US$ 1.15 billion in 2024, increased to US$ 1.41 billion in 2025, and is expected to reach about US$ 9.75 billion by 2034, expanding at a CAGR of 23.85% between 2025 and 2034.

In the Asia-Pacific (APAC) region cell and gene therapy, the market was valued at US$ 4.59 billion in 2024, grew to US$ 5.71 billion in 2025, and is forecasted to reach nearly US$ 39.62 billion by 2034, at a CAGR of 24.04% during the forecast period.

The cell and gene therapy infrastructure market is on a strong growth path, expected to generate significant revenue expansion, potentially reaching several hundred million dollars by 2034, driven by advancements in manufacturing, logistics, and therapeutic delivery systems.

The global cell and gene therapy thawing equipment market was valued at US$ 0.96 billion in 2024, is expected to reach US$ 1.1 billion in 2025, and projected to climb to US$ 3.56 billion by 2034, growing at a CAGR of 14.24% during 2025–2034.

Meanwhile, the global cell and gene supply chain solutions market is estimated at US$ 3.54 billion in 2024, expanding to US$ 4.09 billion in 2025, and projected to achieve US$ 14.95 billion by 2034, reflecting a CAGR of 15.54% over the forecast timeline.

The global cell and gene therapy tools and reagents market stood at US$ 10.04 billion in 2024, rising to US$ 11.12 billion in 2025, and is anticipated to reach about US$ 27.3 billion by 2034, growing at a CAGR of 10.76% from 2025 to 2034.

The global cell and gene therapy bioassay services market is valued at US$ 5.05 billion in 2024, projected to grow to US$ 5.67 billion in 2025, and is expected to reach nearly US$ 16 billion by 2034, progressing at a CAGR of 12.24% during the forecast period.

Cell and Gene Solutions Market Companies

- Sartorius AG

- Miltenyi Biotec

- Charles River Laboratories

- Oxford Biomedica

- Forge Biologics

- Samsung Biologics

- Vivebiotech (Spain)

- ABL Europe (France)

- Cell and Gene Therapy Catapult (UK)

- Minaris Regenerative Medicine

- RoslinCT (UK)

- Exothera (Belgium)

- Yposkesi (France)

- Evotec Biologics

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/checkout/5902

The Cell and Gene Solutions Market Segmentation

By Therapy Type

- Cell Therapy Solutions

- Includes autologous/allogeneic CAR-T, NK, TIL, stem cells

- Gene Therapy Solutions

- Covers viral/non-viral vector production, CRISPR editing, gene silencing

By Service/Technology

- Process Development & Manufacturing (CDMO/CMO)

- Viral vector & plasmid production, cell engineering

- Analytical Testing & Quality Control

- Release assays, potency, sterility, and safety

- Logistics & Cryopreservation

- Cold chain, apheresis transport, real-time tracking

- Regulatory Consulting & Compliance

- IND/IMPD support, GMP validation, EU/FDA bridging

- IT & Automation Platforms

- Manufacturing Execution Systems (MES), eBMR, patient chain-of-identity

- Others (Training, Custom Media, Raw Material Supply)

By Application

- Oncology (CAR-T, TILs, NK Cells)

- Rare Genetic Disorders (e.g., SMA, Hemophilia)

- Ophthalmology (e.g., Luxturna)

- Neurology (e.g., Parkinson’s, ALS)

- Cardiology & Musculoskeletal

- Others (Wound healing, autoimmune diseases)

By End-User

- Biotech Startups & Clinical-Stage Developers

- Large Biopharma

- Academic Institutes & Translational Centers

- Hospitals & Cell Processing Labs

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5902

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.